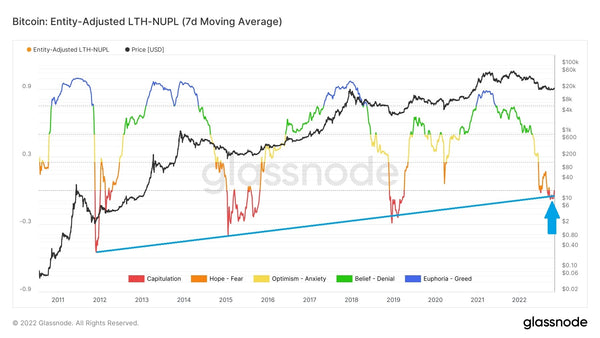

Bitcoin’s long-term holders’ NUPL metric has dropped to levels that coincided with market bottoms thrice since November 2011.

Source: cointelegraph

Bitcoin and the rest of the crypto market have been in a bear market for almost a year. The top cryptocurrency has seen its market valuation plummet by more than $900 billion in the said period, with macro fundamentals suggesting more pain ahead.

Another bear cycle produces more BTC hodlers

But the duration of Bitcoin’s bear market has coincided with a substantial rise in the percentage of BTC’s total supply held by investors for at least six months to one year.

Notably, the percentage of coins held for at least a year has risen from nearly 54% on Oct. 28, 2021, to a record high of 66% on Oct. 28, 2022, data shows.

Bitcoin hodl waves. Source: Glassnode

This evidence suggests that long-term investors are increasingly looking at Bitcoin as a store of value, asserts Charles Edwards, founder of digital asset fund Capriole Investments.

“Despite the worst year in stocks and bonds in centuries, Bitcoiners have never held on to more Bitcoin,” the analyst noted while highlighting how the floor and ceiling in Bitcoin held for the long term have been increasing after each cycle.

Bitcoin hodl waves featuring long-term BTC holding highs and floors. Source: Glassnode/Capriole Investments

Hodler data hints at Bitcoin’s price bottom

Additionally, Glassnode’s research shows that the Bitcoin tokens held for at least five to six months are less likely to be sold. The number of these so-called “old coins” typically rises during bear markets, highlighting accumulation by the patient, long-term investors as short-term investors sell.

The behavioral difference is visible in the chart below, where the downtrend in Bitcoin’s price coincides with a persistent decline in the number of “younger coins” and an increase in the number of coins inactive for at least six months, or “old coins.”

Bitcoin’s percent young (red) vs. old (blue) supply. Source: Glassnode

As of Oct. 31, the old coins comprise nearly 78% of the Bitcoin supply in circulation versus younger coins’ 22%, thus reducing the likelihood of intense sell-offs while forming a potential market bottom.

Moreover, on-chain data tracking Bitcoin’s price and its long-term holders’ (LTH) net unrealized profits and losses (NUPL) hints at a similar scenario.

Notably, Bitcoin’s entry-adjusted LTH-NUPL has entered the capitulation zone (red) that has coincided with the end of previous bear markets, as shown above. That includes the strong bullish reversals witnessed in November 2011, January 2015 and December 2018.

As Cointelegraph reported, MicroStrategy, the world’s largest corporate holder of Bitcoin, has also reiterated its commitment to continue buying BTC for the long term.

“We have a long-term time horizon, and the core business is not impacted by the near-term Bitcoin price fluctuations,” explained MicroStrategy CEO Phong Le.

By Yashu Gola | Original link